Medical and Machinery/Equipment

More growth for medical, but continued contraction is expected for machinery/equipment.

More Growth for Medical

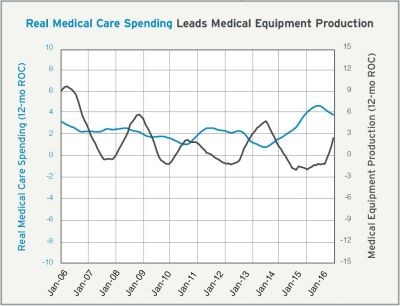

At the start of 2014, real medical care spending was growing at an annual rate of about 1 percent, which was the slowest rate of growth in 20 years. By the end of 2015, spending was growing at an annual rate of almost 5 percent, which was the fastest rate of growth in more than a decade. While the rate of growth in real medical care spending has decelerated in early 2016, the annual rate of growth was still virtually the fastest in more than a decade.

Historically, production of medical equipment tends to lag real medical care spending by 12-18 months. Device production generally has cycled through peaks and troughs every two years. While that cyclical pattern was disrupted by the Affordable Care Act, the historical pattern seems to be back in place. About one year ago, after medical care spending bottomed out at about the start of 2015, medical equipment production also bottomed out, contracting at an annual rate of about 2 percent. The rate of contraction slowly decelerated during 2015, but the rate of change has skyrocketed to start 2016. At the end of 2015, the annual rate of change was contracting at a rate of 1.2 percent, but just five months later, that rate of change was growing at a rate of 2.5 percent. If historic patterns hold, medical equipment production should grow at an accelerating rate throughout 2016, possibly reaching a rate of growth around 9 to 10 percent by the end of the year. This potential rate of growth was last reached around the end of 2005 and beginning of 2006.

Future capital spending plans for the upcoming 12 months have been positive, growing in three of the last six months compared with one year earlier. As a result, the annual rate of change grew in June for the first time since February 2015. This is a positive sign that the medical device industry will be spending more on capital equipment in the remainder of 2016.

Continued Contraction for Machinery/Equipment Market

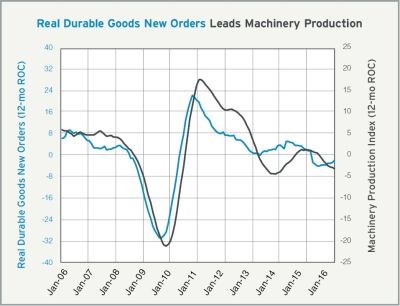

Real durable goods new orders are an excellent leading indicator of machinery and equipment industrial production. In April, new orders were $228,527 million. Compared with one year earlier, durable goods new orders were up 1.2 percent, which marks the second time in three months that orders have increase compared with one year earlier. This comes after a period when orders contracted 10 of 12 months. As a result, the annual rate of change, now -3.1 percent, has reached its slowest contraction since it began contracting in July 2015. The rate of contraction is likely to continue to decelerate in the upcoming months.

Historically, durable goods new orders have led machinery and equipment production by six to 12 months. With new orders having bottomed out in September 2015, machinery and equipment production should hit a bottom before the end of 2016. Machinery and equipment production has been contracting at an accelerating rate since October 2015, and this rate of contraction is likely to accelerate at least for a couple more months (May is the latest data at the time of publishing). Then, production should begin contracting at a decelerating rate. It is quite likely that production will still be contracting at an annual rate by the end of 2016, however.

Related Content

Husky Technologies Showcases Innovation Injection Mold Solutions at MD&M West 2023

This week, MD&M/Plastec West attendees can survey Husky’s latest technologies and services engineered for medical device manufacturers.

Read MoreHow to Improve Your Current Efficiency Rate

An alternative approach to taking on more EDM-intensive work when technology and personnel investment is not an option.

Read MoreMMT Chats: Mold Builder, Master Molder and Marble Maker? Part 1

MoldMaking Technology Editorial Director Christina Fuges introduces new MMT Editorial Advisory Board Member Mike Close, Sr. Tooling Engineer for SMC Ltd. in Devens, Massachusetts. This episode is brought to you by ISCAR with New Ideas for Machining Intelligently.

Read MoreLeading Mold Manufacturers Share Best Practices for Improving Efficiency

Precise Tooling Solutions, X-Cell Tool and Mold, M&M Tool and Mold, Ameritech Die & Mold, and Cavalier Tool & Manufacturing, sit down for a fast-paced Q&A focused on strategies for improving efficiencies across their operations.

Read MoreRead Next

Reasons to Use Fiber Lasers for Mold Cleaning

Fiber lasers offer a simplicity, speed, control and portability, minimizing mold cleaning risks.

Read MoreHow to Use Strategic Planning Tools, Data to Manage the Human Side of Business

Q&A with Marion Wells, MMT EAB member and founder of Human Asset Management.

Read MoreAre You a Moldmaker Considering 3D Printing? Consider the 3D Printing Workshop at NPE2024

Presentations will cover 3D printing for mold tooling, material innovation, product development, bridge production and full-scale, high-volume additive manufacturing.

Read More

.JPG;width=70;height=70;mode=crop)

.jpg;maxWidth=300;quality=90)