Medical and Consumer Goods

Slower growth ahead for medical and consumer goods production.

Slower Growth Ahead for Medical Production

The medical industry is in a sort of holding pattern as it waits to see if the Affordable Care Act will stay on the books as is, be modified, or be scrapped and replaced. At the time of this writing, I’m not sure anyone knows what will happen.

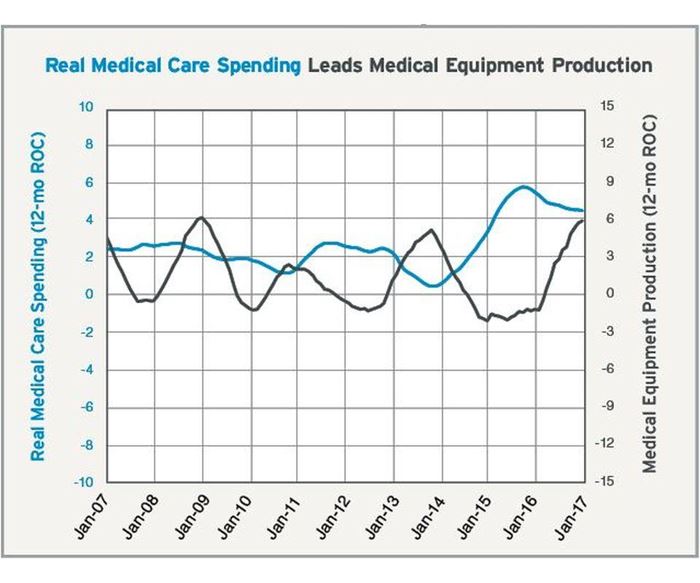

After two years of a nearly straight-line increase, medical care spending since last summer has flatlined. In December 2016, real medical care spending grew 3.5 percent, the slowest rate of growth since June 2014. It was also the first month of below-average growth since June 2014. As a result, the annual rate of growth has decelerated since October 2015, although it has remained above the historical average and is still one of the strongest rates of growth over the last 10 to 12 years.

Medical equipment production tends to lag medical care spending by 12-18 months (matching up the peaks and troughs between the black and blue lines on the chart). With the dramatically accelerating growth in real medical care spending in 2014 and 2015, it came as no surprise that medical equipment production increased dramatically in 2016. It fact, 2016 was the strongest period of growth in medical equipment production since 2007.

The tide appears to be turning, however. In December, medical equipment production contracted 0.9 percent. That was the first month of contraction since the previous December. And the annual rate of change failed to grow at an accelerating rate for the first time since February 2016. It looks like medical production could be in for a period of decelerating growth for the next six to 12 months.

Consumer Goods Production Growing Slower

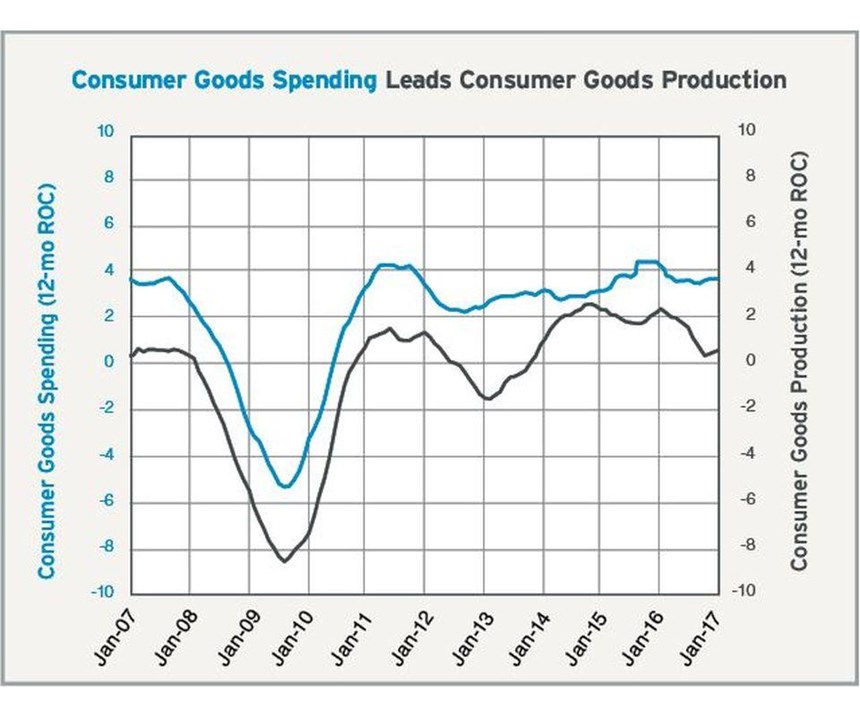

December real disposable income was $12,791 billion (seasonally adjusted at an annual rate). As usual, this was an all-time high in real disposable income. It grew 2.1 percent compared with one year earlier, the slowest rate of month-over-month growth since January 2014. That month-over-month rate of growth was below 3.0 percent in 10 of the last 11 months. The annual rate of growth in real disposable income has decelerated steadily since August 2015 and was 2.7 percent in December, the slowest since October 2014. This was the sixth month in a row that the annual rate of growth was below 3.1 percent, which is the historical average.

Real consumer spending was an all-time high of $11,672 billion (seasonally adjusted at an annual rate). Its month-over-month rate of growth was 2.8 percent and has been below the historic average of 3.3 percent since July 2015. The annual rate of growth remained at 2.7 percent, but it has been about 2.6 or 2.7 percent since last May.

Generally, consumer goods production has grown at a slower rate for most of the last two years. Although there has been a slight uptick in growth in recent months, it has not been enough to change the overall trend.

Related Content

-

Hammonton Mold, ADOP France Forge Strategic Partnership in Injection Blow Moldmaking

Hammonton Mold Inc., a leading full-service mold shop based in New Jersey specializing in injection blow molds (IBM), proudly announces its official partnership with ADOP France, a prominent IBM mold manufacturer based in Normandy, France.

-

Domestic Collaboration Yields Efficiency and Budget Gains For Innovative Tooling Project

Pyramid Molding Group and Lettuce Grow partner to develop optimal tooling for a compact Hydroponic Farmstand.

-

MMT Chats: Digitalizing Mold Lifecycle and Process Performance

MMT catches up with Editorial Advisory Board member Bob VanCoillie senior manager of Kenvue’s mold management center of excellence outside of Philadelphia to discuss mold management via tooling digitalization and OEM expectations and opportunities.

.JPG;width=70;height=70;mode=crop)

.jpg;maxWidth=300;quality=90)