Machinery/Equipment and Automotive

Machinery/equipment likely to contract this year; automotive strong, but slowing.

Machinery/Equipment Market Likely to Contract in 2016

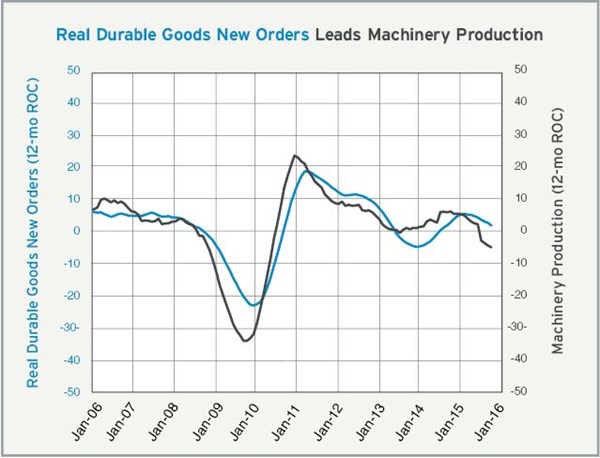

Since the end of 2010, the machinery and equipment market has grown quite significantly, albeit with a brief period of contraction from mid-2014 to mid-2015. However, it seems that machinery and equipment production will likely contract this year. This is based on the trend in real durable goods new orders, which is an excellent leading indicator (by about six months) of machinery and equipment production.

Real durable goods new orders in September 2015 were $246,098 million, down 4.7 percent compared with one year earlier. September was the eighth month in a row that the month-over-month rate of change contracted. The annual rate of change, now -4.2 percent, contracted for the third month in a row at an accelerating rate, and, based on the recent trend in new orders, the annual rate of change will contract even faster in upcoming months.

In addition to these trends, the Gardner Business Index (GBI): Machinery & Equipment shows that new orders and production have contracted at significant rates for seven and eight months, respectively. And because new orders have been relatively weaker than production, backlogs within the industry have continued to contract at an accelerating rate. All of these trends will decrease the demand for plastic components, and consequently molds, needed for machinery and equipment.

Automotive Strong, but Slowing

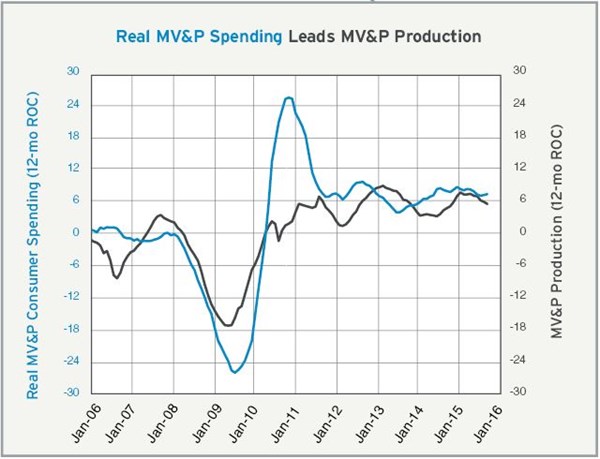

The real 10-year treasury rate was 1.88 percent in October, just two basis points higher than it was the month before, but this was the highest the real rate has been since February 2011. October was also the sixth month in a row that the year-over-year change in the real rate was positive and the ninth month in a row that it increased. The change in the real rate was the highest it has been since January 2014.

The growth rate in motor vehicle and part (MV&P) consumer spending decelerated throughout 2015, and the trend in the interest rate indicates that MV&P consumer spending will see even slower growth in 2016. Production has been growing at a significantly faster rate than spending since 2010. Historically, this is quite unusual, so one should expect that the deceleration in production will be faster than the deceleration in spending to bring the two into a better balance.

One bright spot for moldmakers, however, is that the number of new vehicle launches is very high, which means the demand for tooling in the automotive industry should remain strong even if production levels fall. See related article by Harbour Results on page 14 of this issue.

Related Content

-

Harbour Results, AutoForecast Solutions Release Battery-Electric Vehicle Market Study

The study analyzes the transition from an industry dominated by the internal combustion engine to battery-electric mobility and its impact on the supply chain, which will have ripple effects from automakers to tool and die shops.

-

Project Reveals Added Benefits of New P20 Grade Steel in Machinability, Cycle Time and No Stress Relief

MoldMaking Technology's Christina Fuges talks with General Motors' Shane Appel about a project testing a new P20 steel grade's dimensional stability.

-

Industry Report: Automotive Outlook, Forecast, Disruptions and Industry Transitions

A recent presentation by Auto Forecast Solutions shares some interesting trends to help those who work within the automotive industry better understand key trends.

.JPG;width=70;height=70;mode=crop)

.jpg;maxWidth=300;quality=90)

.jpg;maxWidth=970;quality=90)