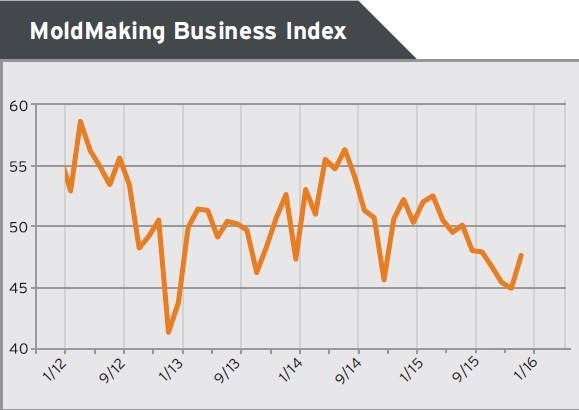

Gardner Business Index: Moldmaking for November 2015

With a reading of 47.5, the Gardner Business Index for moldmaking shows that the moldmaking industry contracted in November for the sixth month in a row. However, the rate of contraction was considerably slower than in previous months, and the index clearly broke out of the downtrend it had been on since February 2015.

With a reading of 47.5, the Gardner Business Index showed that the moldmaking industry contracted in November for the sixth month in a row. However, the rate of contraction was considerably slower than in previous months, and the index clearly broke out of the downtrend it had been on since February 2015.

New orders contracted for the fifth month in a row, but this subindex was at its highest level since June 2015. Production increased for the first time since July 2015, but because production has been generally stronger than new orders, the backlog index continued to contract. This rate of contraction has stabilized in recent months, however. Employment increased for the fourth time in five months. Because of the strong dollar, exports continued to contract in November. Supplier deliveries have lengthened in two of the previous three months, however the rate of lengthening has been relatively slow, indicating there is still some slack in the supply chain.

The material prices index contracted for the fourth month in a row, reflecting the fall in almost all commodity prices due to the weak global economy. Prices received contracted for the second month in a row. Future business expectations have bounced around considerably in recent months, however this trend has been relatively stable compared with the first half of 2015 when expectations were on a downward trend.

The index for companies with more than 250 employees continued to show significant expansion as it has every month but one since October 2014. After two months of contraction, plants with 100-249 employees grew significantly in November and were most responsible for the improvement in the overall index for the month. All other plant sizes have struggled the previous three months, however.

Custom processors contracted for the fifth month in a row, although their subindex improved noticeably in November, reaching its highest level since June 2015. Meanwhile, metalcutting job shops contracted for the sixth time in seven months, posting an index that was just above 40 for the second month in a row.

The Southeast grew at the fastest rate by far in November, the first time the region had expanded since May 2015. The North Central-East region also expanded. The West, however contracted at the same rate as in October, while the Northeast contracted at a slower rate and the North Central-West at a faster rate. The South Central still contracted at the fastest rate, but its index improved significantly in the month.

Future capital spending plans made a major improvement in October and November. While still below average, spending plans have more than doubled from their level in April to July 2015.

.JPG;width=70;height=70;mode=crop)