Business Succession Planning Protects Shop in the Long-Term

How family-owned businesses can secure their success for future generations.

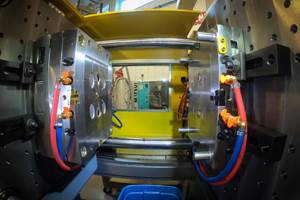

Since 1969, Bomatic Inc. (Ontario, CA) has been producing plastic containers of all shapes and sizes—from blow mold designs and building to final product—in the following industries: personal care, automotive, pharmaceutical, medical, lawn and garden, food, household cleaners and industrial chemicals. Current owner Kjeld Hestehave is extremely proud of the fact it is a family-owned business passed down to him from his father, and wanted to make sure he secured its success for future generations, but did not know where to begin.

Kjeld was a young man himself when his father brought him into the business. “I worked part time until the age of 22, at which time I became a full-time employee and the heir apparent recipient of the business,” he recalls. After his dad retired at the age of 75, Kjeld found himself as the new President and CEO. “I know plastics,” he states. “I have worked in the business for more than 48 years and I know what it takes to make quality molds and plastic parts. What I don’t know is financial planning and/or business succession planning—which includes the transfer of a business from generation I (my parents) to generation II and III (me and my children and nephews, who are now working in the business).”

Enter Kevin La Mont, Vice President–Advance Planning and Investments at RB Capital Management LLC (Fresno, CA), an investment advisor firm specializing in estate tax planning, hedged strategies and managed fixed-income portfolios. Kevin approached the Kjeld two years ago, and asked if he could stop by Bomatic and chat with him about the business and what factors the company was facing in the current economic climate. “As Kevin and I were talking, he looked around and asked who owned the business and the building, which housed the business,” Kjeld states. “I told Kevin that my parents were the primary owners of both, which prompted his nest question, ‘What planning has been implemented by my parents in order to avoid the estate taxes upon their demise?’”

At the time, Kjeld believed that there would not be any taxes since the business and building were held by his parents in their living trust. “Kevin informed me that a Living Trust is great for avoiding probate and its inherent cost, delays and publicity—but does very little to avoid estate taxes. After picking myself up off the floor and regaining my composure, I ask Kevin if there was anything that could be done to reduce and eliminate the family’s estate taxes and the possibility of a forced liquidation of assets.”

Kevin assured Kjeld that there were a number of trusts available that could be used to meet the needs and desires of the family. “These trusts include, but are not limited, to Grantor Retained Annuity Trust, Qualified Personal Residence Trust, Defective Grantor Trust, Private Foundation and Self-Canceling Installment Notes,” LaMont explains. “By using these trusts alone or in combinations with each other, the parents would be able to achieve the following:

• Keep Bomatic Inc. as a thriving company.

• Transfer the bulk of value of the business and building to trust for estate tax planning.

• Maintain a degree of control over the business and its operation.

• Continue to receive income from the business and/or real estate in order to maintain their (parents) standard of living.

• Provide protection against claims judgments and possible lawsuits.

• Keep the business and building in trust for multiple generations.

The Hestehave family chose to use a combination of a Private Annuity for the building and a Grantor Retained Annuity Trust for the business. “The Private Annuity allows Kjeld’s parents to receive the rent from the building (just as they do now) in order to maintain their standard of living,” LaMont explains. “However, upon their demise the building will not be considered part of their estate. As for the business, the Grantor Retained Annuity Trust will allow Kjeld’s parents to receive income, but only for a number of years at which time the business will transfer to a trust for the benefit of Kjeld, the grandson and nephew.”

“As many know, being a business owner is hard work,” Kjeld comments. “The hours are long and the stress can be relentless—not to mention the daily interruptions and distraction one is constantly bombarded with—and those are the good days. With all that we endure as business owners, I feel a great burden has been lifted off my shoulders. There is a sense of comfort knowing that at some time in the future, the family business (which we have poured our hearts and souls into) and the real estate will be protected from estate taxes.”

Kjeld offers the following advice to fellow mold manufacturers. “Don’t assume that what you think will happen, will happen. Meet with an advisor who understands complex estate and business succession planning tax laws and the tools which are available. Remember, not having a plan is a plan to fail. Our plan now ensures that Bomatic will be here—not only during my years of running the business—but for my children and nephews as well.”

For More Information

RB Capital Management LLC / (949) 861-4362

kwlplanner@yahoo.com / rbcapitalmanagement.com

Bomatic Inc. / (909) 947-3900

sales@bomatic.com / bomatic.com

Related Content

Unique Mold Design Apprenticeship Using Untapped Resources

To help fill his mold design skills gap, Jeff Mertz of Anova Innovations, is focused on high schools and underprivileged school districts, a school that has lower graduation and college entrance rates. The goal is a student-run enterprise.

Read MoreMMT Chats: The Connection Between Additive Manufacturing Education and ROI

This MMT Chat continues the conversation with Action Mold and Machining, as two members of the Additive Manufacturing team dig a little deeper into AM education, AM’s return on investment and the facility and equipment requirements to implement AM properly.

Read MorePredictive Manufacturing Moves Mold Builder into Advanced Medical Component Manufacturing

From a hot rod hobby, medical molds and shop performance to technology extremes, key relationships and a growth strategy, it’s obvious details matter at Eden Tool.

Read MoreHands-on Workshop Teaches Mold Maintenance Process

Intensive workshop teaches the process of mold maintenance to help put an end to the firefighting culture of many toolrooms.

Read MoreRead Next

Succeeding in Business and Business Succession

Paying attention to the business is as important as the craft.

Read MoreReflections on Business Succession and Lessons Learned

Part one of how to plan for unexpected inherited business ownership.

Read MoreReasons to Use Fiber Lasers for Mold Cleaning

Fiber lasers offer a simplicity, speed, control and portability, minimizing mold cleaning risks.

Read More

.jpg;maxWidth=300;quality=90)