The Data is in, and It's Looking Good

Forecasted spending for new equipment in 2014 indicates strong growth in the metalworking industry, particularly among mold manufacturers.

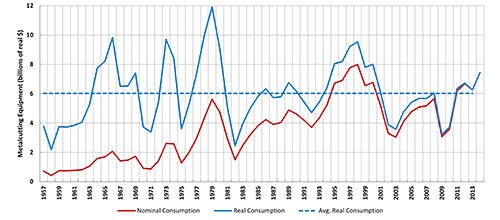

Projected overall spending in 2014 is $7.442 billion, which is up 19 percent from the 2013 estimate and roughly 25 percent more than the historical average (click to enlarge).

Next year, industrial mold shop spending on machine tools and other equipment is forecast to increase nearly three times compared to 2013 levels.

That tidbit is courtesy of the latest data from Gardner Business Media—which, if you weren’t aware, offers a variety of valuable market research in addition to publications like MoldMaking Technology. Perhaps the best example is the Capital Spending Presentation, an annual forecast of projected spending on new machine tools, cutting tools and workholding equipment by U.S. durable goods manufacturers. The report is compiled by Steve Kline, Gardner’s research director of intelligence, who has been on the road in recent weeks to present this year’s data at various industry events.

As for the equipment these shops are looking to buy, horizontal machining centers are one standout, particularly those with pallets larger than 800 mm. Spending on these machines is expected to increase by nearly 100 percent and account for roughly 35 percent of the total $7.442 billion total machine tool sales (the largest volume of machine tools sold since 1998, in real dollars). More than half of manufacturers expected to purchase these large HMCs are job shops, and 40 percent of those job shops are industrial mold shops. Wire and ram EDM sales are also expected to increase.

To see the whole report, click here.

.jpg;maxWidth=300;quality=90)