Brighter Days this Summer for Moldmakers

The American Mold Builders Association just released its Summer Business Forecast whose participants are executives from 90 mold building companies, representing nearly 3,000 shop floor and design employees. And the survey says ... Mold Building Industry Continues to Stabilize.

The American Mold Builders Association just released its Summer Business Forecast whose participants are executives from 90 mold building companies, representing nearly 3,000 shop floor and design employees. And the survey says ... Mold Building Industry Continues to Stabilize.

Over the course of many years, the American Mold Builders Association (AMBA) has routinely examined the trends of the mold building industry by utilizing the final results of its quarterly economic surveys. Although many micro trends can be identified by comparing the current state of business operations to those of three months prior, a macro trends analysis of the state-of-the-industry can provide a better understanding of what is truly happening in the areas of employment, demand measured by median weekly employee work hours and operational benchmarks including, but not limited to, quoting trends, shipping and backlog status and overall profitability.

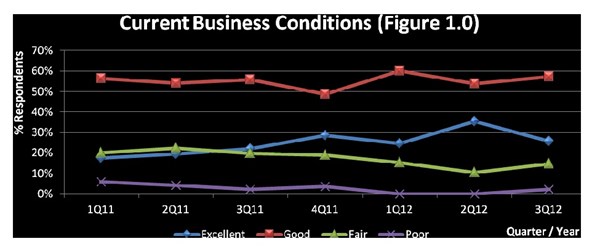

AMBA’s Summer 2012 Business Forecast Survey was conducted via an online format for a period of two weeks. Executives from 90 mold building companies, representing nearly 3,000 shop floor and design employees, participated in the survey process. Viewing the reported data from a short-term basis, business conditions for the majority of moldmakers across the United States remain very stable as 83 percent with participants indicating conditions as excellent or good. More importantly, however, is the stability of business conditions in the moldmaking industry that is represented in the trend line over the last seven quarters. As can be seen in Figure 1 below, on average, nearly 85 percent of survey respondents have reported either excellent or good business conditions over the last twenty-one months.

While predicting the future always remains a daunting task, combining data derived from “current business conditions” along with what leaders are forecasting for the next quarter, reveals a continuation of solid business conditions throughout the remainder of 2012. Since the fourth quarter of 2011, company executives consistently have reported positive forecasts for the upcoming three-month periods and have routinely met forecasted expectations. As Figure 2 demonstrates, mold building executives remain “bullish” about the future with 89 percent of survey participants indicating an increase or stable future over the next three months.

.jpg;maxWidth=600)

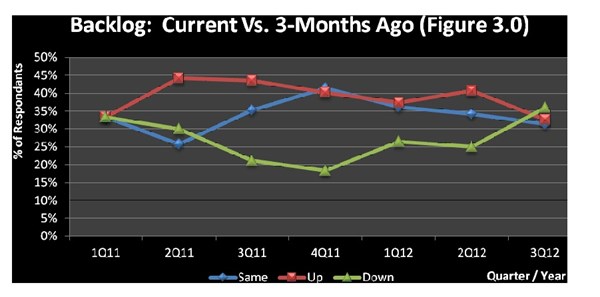

There is some irony to the next three-month business forecasts when examining the macro trend lines for the last eighteen months. Although business forecasts remain strong, operations indicators divulge a slight momentum change. Most revealing are the overall trend lines with “backlog” and “shipments.” Viewing data provided in AMBA’s economic surveys over the last nine months on backlog status and applying linear regression to data collected since the fourth quarter of 2011, “backlog” appears to be decreasing slightly and shipment volume appears to be following the same trend line.

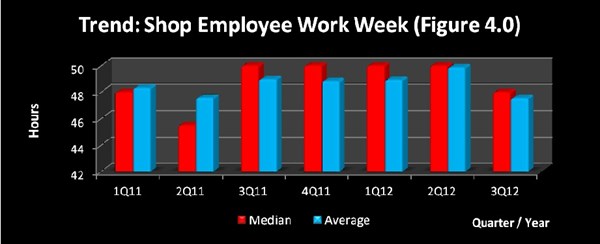

In addition to the data revealing a slight momentum change from previous quarters, the median and average trends in the number of hours comprising the shop employee work week have slightly decreased from those reported over the last four quarterly surveys. The employee work week for design and engineering professionals mirror this same trend.

.jpg;maxWidth=970;quality=90)

.jpg;maxWidth=300;quality=90)