Moldmaking Opportunities and Challenges Within the Current Economic Cycle

Report analyzes moldmaking trends, pricing, labor shortages, capital costs, competitiveness strategies and construction spending challenges.

Moldmakers must continue to monitor economic shifts to plan for plastics industry growth opportunities. Source | Getty Images

Those in the plastics industry recognize the significant role that plastics and plastic products play in manufacturing. Plastics are used across various applications and end markets due to their cost-effectiveness and unique material properties. As a result, the manufacturing sector is the primary customer for the plastics industry. Additionally, the relationship between plastics and manufacturing is cyclical, with both industries experiencing growth and contraction in accordance with the broader economy.

The U.S. economy grew at a solid rate of 3.0% in the second quarter. However, there are areas where performance has been lackluster, overshadowed by strong growth in other sectors. Advanced estimate from the Bureau of Economic Analysis shows that GDP grew 2.8% in the third quarter. This indicates that while the overall economy is expanding, there are significant disparities at the microeconomic level.

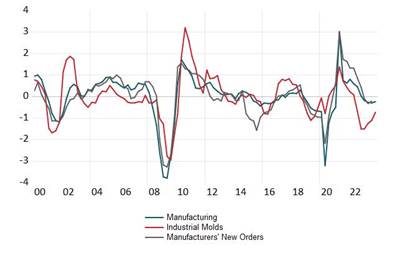

Figure 1. Industrial production stagnates in manufacturing while declining in construction, signaling economic sector-specific challenges. Source | Board of Governors of the Federal Reserve System

For example, while GDP is humming at rates above the U.S. long-run average growth rate, housing market activity has declined, and manufacturing activity, on-trend, has flattened. As shown in Figure 1, the Industrial Production Index on manufacturing has moved sideways, and the Industrial Production Index on construction supplies, which captures plastics in the home building space, decreased following the increase post-COVID-19 recession in April 2020. So, it can be said that it is a strong U.S. economy, excluding housing and manufacturing. Weakness in overall manufacturing in the economy had knock-on effects on moldmaking. The extent of the spillover effects can be analyzed using proxy data.

Moldmaking Metrics and Proxies

The latest GBI Moldmaking, which was 42.8 in September/October, is another indication of weaker-than-expected moldmaking activity. Other than the GBI there are moldmaking proxies that provide key information.

In the hierarchy of the North American Industry Classification System (NAICS), the six-digit national industry classification for industrial molds (NAICS 333511) falls under the four-digit industry group (NAICS 3335) for metalworking machinery. In the PLASTICS Quarterly forecast from the Plastics Industry Association, estimates for industrial molds are derived from the broader measurement of metalworking machinery (see Table 1).

Table 1. Industrial molds (NAICS 333511) forecasts derive from broader metalworking machinery industry data measurements. Source | U.S. Census Bureau

Manufacturers’ new orders for and shipments of metalworking machinery have been decreasing. The result is a predictable rise in inventory. As shown in Figure 2, new orders for metalworking machinery peaked in October 2021, reaching $3,149 million, and since August 2022 have oscillated around $2,701 million monthly.

Shipments, on the other hand, peaked in November 2022 valued at $2.923 million and thereafter also downtrended to a monthly average of $2,738 million. Total inventories of metalworking machinery have continued to increase since bottoming at $5,814 million in December 2020. Since then, inventories have been on the rise.

Figure 2. Metalworking machinery shows declining orders and shipments since 2022 peaks, while inventories rise steadily. Source | Board of Governors of the Federal Reserve System

As the end of the year approaches, businesses that began strategizing for 2025 midway through the year are hoping for sustained economic growth. Broad-based economic expansion is essential for manufacturing to regain momentum, which would, in turn, benefit other sectors like the plastics industry supply chain.

Price Stability Is Key

Economic growth anchored in stable prices is essential for the plastics industry. According to the 2024 Size and Impact Report on the plastics industry, material costs are a significant expense. In 2023, they accounted for 46.0% of the value of shipments in plastics conversion and 38.0% in molds for plastics manufacturing. While stable prices support economic health, price volatility challenges businesses, including manufacturing.

The Producer Price Index for industrial mold manufacturing, specifically for metal injection molds used in plastics, rose 1.4% year-over-year in May, down from a peak 3.7% increase in October 2022. Although price increases have moderated this year, potential shocks from rising energy and steel costs could add upward pressure.

“A sustained path toward stable prices, increased productivity and a skilled labor force is essential for realizing sustained growth across the plastics and manufacturing industries.”

Skilled Labor Crisis Continues

Broad-based economic growth also requires flexible markets, enabling businesses to adjust labor inputs in response to changing conditions. However, finding skilled labor in manufacturing has been an ongoing challenge for the U.S. economy, affecting competitiveness both domestically and internationally.

According to PLASTICS estimates, labor costs in moldmaking for plastics accounted for 28.1% of revenue in 2023. Since June, the average hourly wage in manufacturing has risen faster than headline inflation. The latest Bureau of Labor Statistics data indicates that wages increased by 5.0% in September, while inflation was 2.4%. For most Americans, employment is the primary source of income, supporting consumption. Real wage growth, when accompanied by productivity gains, fuels sustained economic growth.

Higher Capital Costs Impede Growth

The higher cost of capital has created headwinds for the U.S. plastics industry, as its primary market — the manufacturing sector — faces an interest-rate-driven slump. Higher interest rates push up the required rate of return on capital, which in turn raises risk aversion, potentially stalling new product introductions and projects requiring new tooling.

In 2023, capital expenditures (CapEx) in moldmaking for plastics fell to $238.1 million, a 34% drop from 2022, reflecting the strain of elevated interest rates. The Federal Reserve’s 50-basis-point rate cut in December may be followed by additional cuts in the coming year, potentially rebalancing CapEx across the economy. However, achieving the Fed's longer-term target rate of 2.9% will depend on where the economy stands in the business cycle.

New Strategies For U.S. Competitiveness

It is no secret that Asian economies have aggressively pursued industrial policies in pursuit of global competitiveness. While the U.S. has not done so in the previous years, think tanks are critiquing the recent American-style industrial policy, as reported by the Center for American Progress: “How Biden’s American-Style Industrial Policy Will Create Quality Jobs,” October 27, 2022. The Inflation Reduction Act, the CHIPS and Science Act and the Infrastructure Investment and Jobs Act, reflect the Biden Administration’s bid to boost economic growth.

Clean energy and climate change are at the core of the Inflation Reduction Act, with a goal of achieving a net-zero economy by 2050. This includes incentives for renewables and alternative sources of energy — wind, solar, hydroelectric, etc. Alternative sources of energy come with both challenges and opportunities. The CHIPS and Science Act is aimed at bringing the semiconductor industry back to the U.S. Its spillover effects are hoped to revitalize domestic manufacturing. Whether the CHIPS and Science Act will accomplish its goal remains to be seen — too soon to tell.

“U.S. plastics sector awaits post-election Fed policy while navigating growth challenges amid mixed economic conditions.”

Limitations of Increased Construction Spending

In August, the U.S. Census Bureau estimated the nominal value of construction spending in manufacturing at $238.3 billion, up from $201.5 billion in August of the previous year and nearly double the $129.7 billion recorded in August 2022. While analysts in financial markets may view this increase in construction spending as an indicator of rising manufacturing activity in the U.S. economy, such conclusions seem speculative. The Inflation Reduction Act provides for tax incentives encouraging the adoption of energy-efficient upgrades in new and existing buildings.

An increase in manufacturing structures does not necessarily equate to greater manufacturing output. A more reliable benchmark for assessing the impact of the CHIPS and Science Act is the share of manufacturing as a percentage of GDP, which can only be meaningfully evaluated over time.

Looking Ahead

The U.S. plastics industry remains an essential contributor to the broader manufacturing sector. This applies to all components of the plastics industry supply chain, such as moldmaking, reflecting both the opportunities and challenges within the current economic cycle. If there is one thing the business community is eagerly waiting for after the Presidential election, it is how the Federal Reserve navigates interest rate setting and the broader macroeconomic policy of the U.S., affecting materials costs, labor constraints and capital investment shortfalls that continue to impact growth.

Despite robust GDP projections in 2024, the economy faces uneven microeconomic conditions, particularly in housing and manufacturing. A sustained path toward stable prices, increased productivity and a skilled labor force is essential for realizing sustained growth across the plastics and manufacturing industries, supporting their roles as pillars of the U.S. economy.

Related Content

The Role of Social Media in Manufacturing

Charles Daniels CFO of Wepco Plastics shares insights on the role of social media in manufacturing, how to improve the “business” side of a small mold shop and continually developing culture.

Read MorePredictive Manufacturing Moves Mold Builder into Advanced Medical Component Manufacturing

From a hot rod hobby, medical molds and shop performance to technology extremes, key relationships and a growth strategy, it’s obvious details matter at Eden Tool.

Read MoreOEE Monitoring System Addresses Root Cause of Machine Downtime

Unique sensor and patent-pending algorithm of the Amper machine analytics system measures current draw to quickly and inexpensively inform manufacturers which machines are down and why.

Read MoreMold Design Review: The Complete Checklist

Gerardo (Jerry) Miranda III, former global tooling manager for Oakley sunglasses, reshares his complete mold design checklist, an essential part of the product time and cost-to-market process.

Read MoreRead Next

Moldmaking Industry's Path Amid Economic Shifts

Entering the second half of 2024, moldmakers navigate challenges and opportunities with plastics industry resilience and potential economic surprises providing hope.

Read MoreNavigating Economic Resilience and Consumer Trends

Consumer behavior provides mold builders insight into the evolving market dynamics of goods and services that helps strategic planning.

Read MoreShift in U.S. Mold Imports: Emerging Countries Gain Ground in Market Share

The dynamic nature of the U.S. mold industry's global trade landscape offers challenges and opportunities for growth.

Read More

.jpg;maxWidth=300;quality=90)