Specialization and Automation Give Matrix an Edge on Competitors

Mold shop’s focus on high-tech capabilities and full-service operation earns it a niche in precision tools.

Electronics is a daunting market for moldmakers. Rapid product changeover, short leadtimes and tight production tolerances are basic to mold development. Add in relentless price pressure from OEMs and heady offshore competition, and it’s easy to see how the market can challenge even the most carefully crafted business plans.

Many moldmakers overcome these factors by developing niches in specialized areas of design and fabrication. With on-time delivery a given, mold build expertise in areas critical to electronics design trends gives toolmakers a major advantage in winning business, maintaining profit margins and staying ahead of competitors.

Key trends in electronics that affect mold specifications include ongoing miniaturization, multicomponent capabilities, heat-resistant parts and tight dimensional tolerances. The last two typically mandate the use of engineering resins that also pose flow problems in high-cavity molds.

One company that leverages its moldmaking expertise in these areas to good effect is Matrix Tooling Inc. (Wood Dale, IL). The firm’s specialties include miniature and micro molds, molds for complex, mechanical parts and multicomponent molds.

Matrix, which also has an injection molding operation called Matrix Plastic Products, works in a number of high-tech markets. Besides electronics, these include medical, which accounts for most of its toolmaking business, automotive and consumer products. The company is a one-stop source for services vital to mold and product development: R&D, design, prototyping and injection molding.

On the molding side its capabilities include a Class-100,000 clean room, assembly operations and inspection services. Matrix operates 11 injection machines ranging from 22 to 300 tons. Moldmaking, though, is 60 percent of business.

The ability of Matrix to work with OEMs at the beginning of product development cycles, and provide technical support and services through part production, make it an important resource for companies seeking mold fabrication that meets the short time-to-market cycles of electronics.

The company’s operations also serve as a template for the changing nature of moldmaking in North America. With relatively high costs built into operations vis-à-vis those in many offshore areas, mold shops in the U.S. and Canada are fine-tuning their design and engineering capabilities and investing in productivity enhancements like automation to compete for the high-tech jobs that are crucial to business growth.

“Electronics is really no different than any other industry,” says Paul Ziegenhorn, President of Matrix Tooling and Matrix Plastic Products. “We have to give a customer a compelling reason to spend more money in the United States for a tool than it might elsewhere.”

One way Matrix does this is by specializing in molds with extremely tight dimensions. It has built molds for parts with tolerances down to 0.0004 inches. The company also is experienced in working with engineering resins that figure prominently in electronic parts, many of which have narrow processing windows. These include polyetheretherketone, polyetherimide, liquid crystal polymer, filled nylons and polyesters, ultrahigh-molecular-weight polyethylene and elastomers.

Ziegenhorn notes that for many advanced electronics parts, it’s a matter of time until offshore competitors gain the skills to build molds for them, usually at considerably less cost than in the U.S.

“The equipment we use is available to anyone worldwide, so it’s really the skill of the people who are designing and building the molds [that makes the difference],” he says.

Other factors weigh in as well. Ziegenhorn says that some OEMs prefer to deal with domestic moldmakers to avoid misunderstandings that might result from language or culture. “The language issue is still a problem, even if you go through a third party that speaks English.”

Distance also is a factor—shipping a mold back to Asia, for example, to correct a problem is not an option with tight product delivery schedules.

A recurring issue is protection of intellectual property. “Some of our customers are concerned about confidentiality and do not want to develop products in areas where they don’t have a lot of control,” he says.

A recent benefit to North American moldmakers, especially those in the U.S., is price. The declining value of the U.S. dollar has narrowed the price differential of molds made offshore, especially in China, where inflation is growing almost inline with GDP. The World Bank in June revised its forecast of inflation in China to 7 percent this year from an initial projection of 4.6 percent in February. GDP growth has been pegged at 9.2 percent.

Nevertheless, Ziegenhorn says he has seen “some pretty small and intricate parts that have been built in China,” and expects it’s only a matter of time until more moldmakers there will be able to challenge Western mold builders in designs calling for advanced engineering and fabrication.

Matrix’s moldmaking equipment includes CNC milling systems and wire and sinker EDMs. The company uses machining centers from Mazak, EDM systems from Makino and Charmilles, and graphite mills from Makino. Matrix uses a range of design and production software, including 3-D programs, and provides laser welding.

An important capability is automation. Matrix began adding robotic moldmaking cells in 2000, and now has three “lights-out” lines for CNC machining and sinker EDMs that can run 24/7. Ziegenhorn says the automated cells are essential in achieving the accuracy necessary for miniature and micro molds. They also improve productivity—“workpieces can be prepped and ready to go while a machine is cutting something else”—and reduce the number of man-hours invested in moldmaking, thereby cutting costs and possibly increasing profit margins.

Matrix plans to add automation, this time for wire EDM systems. Ziegenhorn says the units will be more difficult to automate for the type of work Matrix specializes in—miniature and micro molds—because more factors are involved. These include handling and stabilizing workpieces and threading wires. Wire EDM units also tend to have greater maintenance requirements. “The technology isn’t there for ‘lights-out’ operation as readily as it is for other areas,” he remarks.

The company will, however, work to develop viable wire EDM automation systems with current suppliers, primarily System 3R and Erowa. Matrix is currently evaluating equipment.

Matrix has been in business for 30 years. It employs 55 at a 30,000-square-foot facility.

Since it started operations in February 1978, Matrix has weathered a lot of business cycles. Ziegenhorn sees the current U.S. fiscal crisis changing the way a lot of companies operate. For moldmakers, it will continue the harsh but necessary transformation of the industry into one that’s leaner, more expert and better able to compete on a global scale.

“There’s no question that things will change. But the upside is there’s an awful lot of competition when there’s too much capacity. The free market will start whittling away at that. The strongest will survive, and we hope to be among them.”

Related Content

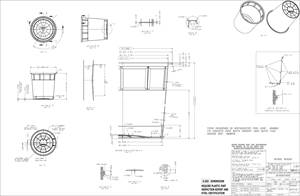

It Starts With the Part: A Plastic Part Checklist Ensures Good Mold Design

All successful mold build projects start with examining the part to be molded to ensure it is moldable and will meet the customers' production objectives.

Read More6 Ways to Optimize High-Feed Milling

High-feed milling can significantly outweigh potential reliability challenges. Consider these six strategies in order to make high-feed milling successful for your business.

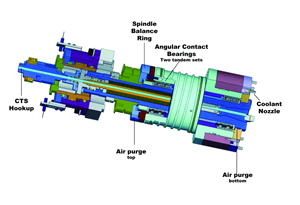

Read MoreMachining Center Spindles: What You Need to Know

Why and how to research spindle technology before purchasing a machining center.

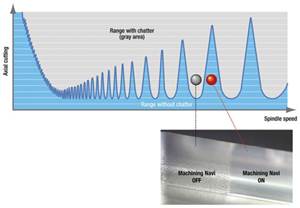

Read MoreHow to Eliminate Chatter

Here are techniques commonly used to combat chatter and guidelines to establish a foundation for optimizing the moldmaking process.

Read MoreRead Next

Simplify Mold Design with Robotic Automation

Six-axis jointed robots can offer significant cost savings during mold design and manufacture, as well as during production.

Read MoreHow to Use Continuing Education to Remain Competitive in Moldmaking

Continued training helps moldmakers make tooling decisions and properly use the latest cutting tool to efficiently machine high-quality molds.

Read MoreHow to Use Strategic Planning Tools, Data to Manage the Human Side of Business

Q&A with Marion Wells, MMT EAB member and founder of Human Asset Management.

Read More